A Tale of Two Tech Workplaces

Large companies come to Jerde Analytics to help them make sense of their data and bring relevance and action to their workplace strategy. We’re fortunate enough to be able to assess how different companies (and cultures) approach risk-taking and decision-making with their data, and to learn what works (and what doesn’t) as it translates to workplace experience.

New clients typically want us to tell them what their closest competitors are doing. Because we’re a ‘data company’, the question is usually about assigned versus shared seating, headcount-to-room ratios, amenities and area per seat calculations. The utility of this space-centric benchmarking is very limited, as it is emphasizing the solution over the problem.

Two Techs

The right question for a new client to ask about benchmarking and workplace:

How much agency do my competitors grant their employees on where to work: office or home?

When onsite, how much flexibility do my competitors offer their employees on where and how to work?

On the surface, these aren’t “data questions” because the answer is not numeric. But the answer to these questions yield a much more useful benchmark than, for example, “110 square foot per person”.

Two Tech Clients

Both are global titans of industry with an employee activity focus on software and hardware engineering. In the physical environment both companies are set up in a “teams” structure: neighborhoods are allocated to feature teams (approx. 6 – 20 persons, depending on function) who have discretion for seating arrangements. As they are both global, teams are often distributed across locations and time zones, which has increased due to the proliferation of hybrid work.

The profile of each client’s real estate portfolio is similar: a headquarters which is primarily owned and operated, and a footprint outside of HQ that is mostly leased.

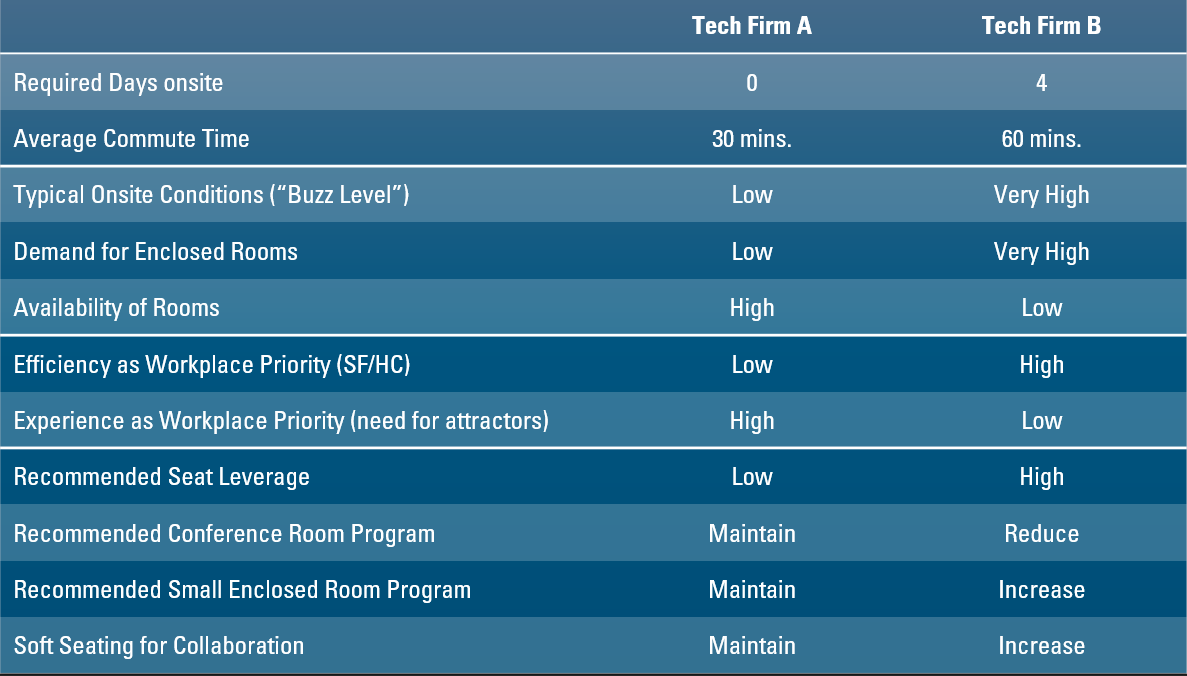

The appropriate space program for Tech Firm A differs considerably to Tech Firm A. Firm A does not have a space deficit problem, but their current footprint is larger than demand given the realities of hybrid work. Onsite workers from Firm A are going to the office either because they can’t focus at home, or for specific tasks that require face to face interaction. In order to encourage attendance, Firm A should invest in more experiences to attract people to the office, including amenities and services.

Tech Firm B is in the opposite position. They are often in space deficit conditions where people are scrambling to find spaces conducive to the new realities of working, especially virtual calls (Zoom, Teams). Since Firm B is more efficiency-driven, they have to restructure their space program to accommodate the new realities, most likely reducing their conference room program and boosting investments in most unreservable small enclosed rooms (focus, huddle and phone rooms). Firm B is less tasked with investment in experience because onsite attendance isn’t optional. They will have to balance their mandate with an experience that enables people to do their best work.

Returning to the question of benchmarking, there is no one-size-fits-all, even for competitors who seem to have so much in common.

At Jerde Analytics, all insights are driven by analysis of client proprietary data. If you feel that your firm’s workplace can benefit from informed decision making, we are happy to join you for an orientation to our project experience and services.